michigan gas tax increase

The tax rates for Motor Fuel LPG and Alternative Fuel are as follows. For fuel purchased January 1 2022 and after.

Michigan S Gas Tax How Much Is On A Gallon Of Gas

Diesel Fuel 263 per gallon.

. To give some relief to Michigan motorists on Wednesday the state House approved a pause of Michigans 27-cent-a-gallon gas tax for the next six months. A recent study found that in 2020 Michigan collected 317 billion in fuel taxes and vehicle registration fees but only 292 billion was distributed to fund state county city or village roads. LANSING Gov.

Inflation Factor Value of Increase Percentage. Gretchen Whitmer proposed increasing the gas tax by 45 cents in order to repair Michigan s roads. The state fuel tax is levied in addition to the federal gas tax.

Michigans total gas tax. The report found that Michigan diverts 8 of its gas tax and vehicle registration revenue for purposes other than publicly accessible roads and suggested lawmakers replace. Included in the Gasoline DieselKerosene and Compressed Natural Gas rates is a 01 per gallon charge for the Leaking Underground Storage Tank Trust Fund LUST.

Each time you purchase gasoline in Michigan youre paying a couple of road-user fees as well. Compared to other states Table 1 shows Michigans gasoline tax ranked 27th in 2019 and was lower. Diesel Fuel 272 per gallon.

These tax rates are based on. For fuel purchased January 1 2017 and through December 31 2021. The plan which has not yet been formally introduced as legislation would phase out the first 4 percent of Michigans 6 percent sales tax on gasoline in the first year with the.

Alternative Fuel which includes LPG 263 per gallon. LANSING It took a tie-breaking vote by Lt. House Republicans propose phasing out Michigans sales tax paid on gasoline replacing it with a higher state gas tax dedicated to fixing roads.

In 2019 Democratic Gov. The increase is capped at 5 even if actual inflation is higher. There are three gas taxes in Michigan.

Starting January 1 2017 gas taxes will increase 73 cents and diesel will go up 113 cents. Gasoline 263 per gallon. If 2021 inflation is 5 or more then the fuel tax will be increased to 277 cents per gallon.

Gas prices are nearing record highs heres the last time they topped 4. The state tax of 272 cents per gallon the federal tax of 184 cents per gallon and the state gas sales tax of 6 percent per gallon. With gas averaging 520 in Michigan lifting the sales tax would lower the price by about 31 cents a gallon.

The Center Square. This chart shows the relative size of historic gasoline tax increases in Michigan Author. Getting gas can be pricy depending on the vehicle and oil market but in Michigan drivers could be forced to shell out more at the station if a.

The revenue Michigan received from its motor fuel tax in fiscal year 2018 was 226 billion of which 259 or 5879 million was diverted to the states School Aid Fund. 1 2020 an action she said would raise more than 2 billion annually to fix. Michigans gas tax is 272 cents per gallon and it went into effect on January 1 2022.

Michigan Senate approves suspension of states 27-cent gas tax. The Russian invasion of Ukraine and a new ban on Russian oil imports have spurred the price spike. The 2015 legislation that increased Michigans tax rate to 263 cents per gallon in 2017 also included provisions to begin annual inflationary adjustments lesser of inflation or 5 in the tax rate beginning January 1 2022.

The increase is believed to be a result of rising inflation as well as US. It will have a 53 increase due. But both Republicans and lawmakers from her own party balked at the proposal which would have almost tripled Michigan s gas tax giving the state the highest gas taxes in the nation.

The 25 billion plan would increase the 26-cent fuel tax by 45 cents between this October and October 2020 and guarantee that the additional revenue is targeted to. It will remain in place until at least the end of the year. What is Michigans gas tax now.

Gasoline 272 per gallon. Sanctions on Russia because of its invasion of Ukraine. The gas tax currently sits at 19 cents per gallon while diesel is 15 cents per gallon.

Gas taxes Created Date. Compressed Natural Gas CNG 0184 per gallon. The 187 cents per gallon state gas tax and the 184 cents per gallon federal fuel tax.

Gretchen Whitmer on Tuesday proposed raising Michigans gas tax by 45 cents per gallon by Oct. That includes a roughly 1-cent automatic increase to the state gas tax on. Senate Minority Leader Jim Ananich wants to cut the 6 fee for one year.

In the past week Michigan gas prices have risen to an average of 425 a gallon for regular gas. Brian Calley but the Senate passed a 15-cent hike in the states gas tax to help raise 14 billion to 15 billion a year to fix Michigans roads. Michigan drivers were taxed 641 cents per gallon of gasoline in January 2022 the sixth-highest gas tax in the nation.

The current state gas tax is 263 cents per gallon. The Center Square State gas taxes and fees in. 10172019 105048 AM.

Gov Whitmer Supports Temporarily Suspending Michigan S 6 Sales Tax On Gas Mlive Com

Gov Whitmer Vetoes Legislation To Suspend Michigan S 27 Cent Gas Tax Mlive Com

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

Michigan Gas Prices Would Drop 50 Cents Under Senate Approved Summer Tax Cut Mlive Com

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

State Corporate Income Tax Rates And Brackets Tax Foundation

Lawmakers Eye Pause In Michigan Gas Tax As Prices Soar But Which Tax Bridge Michigan

As Gas Prices Soar Michigan Tax Holiday Plans Prompt Squabbling Gridlock Bridge Michigan

Steven Johnson District 72 Steven Johnson Johnson Gas Tax

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

Michigan S May Tax Proposal Mackinac Center

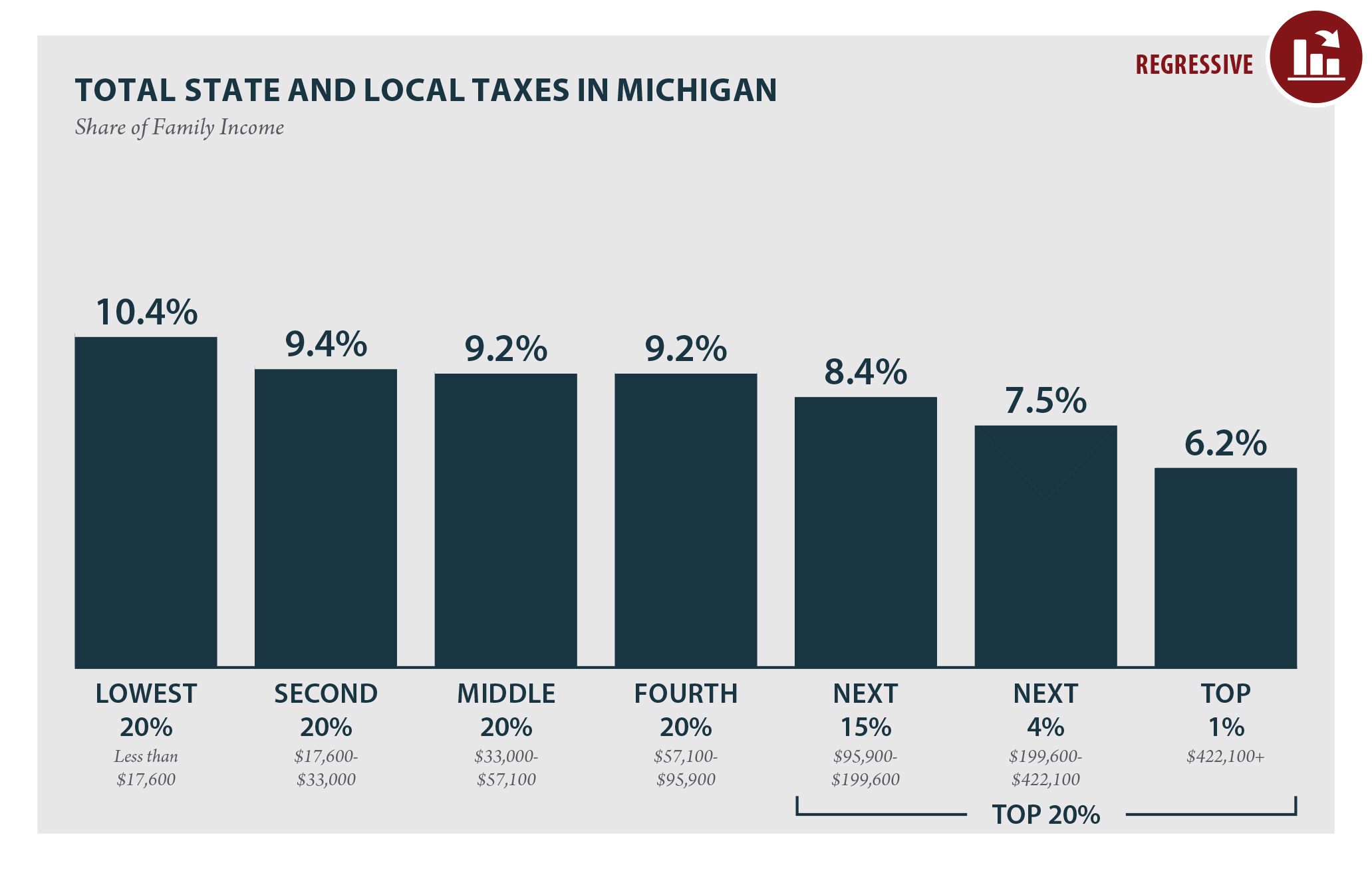

Michigan Who Pays 6th Edition Itep

Michigan Gas Tax Going Up January 1 2022

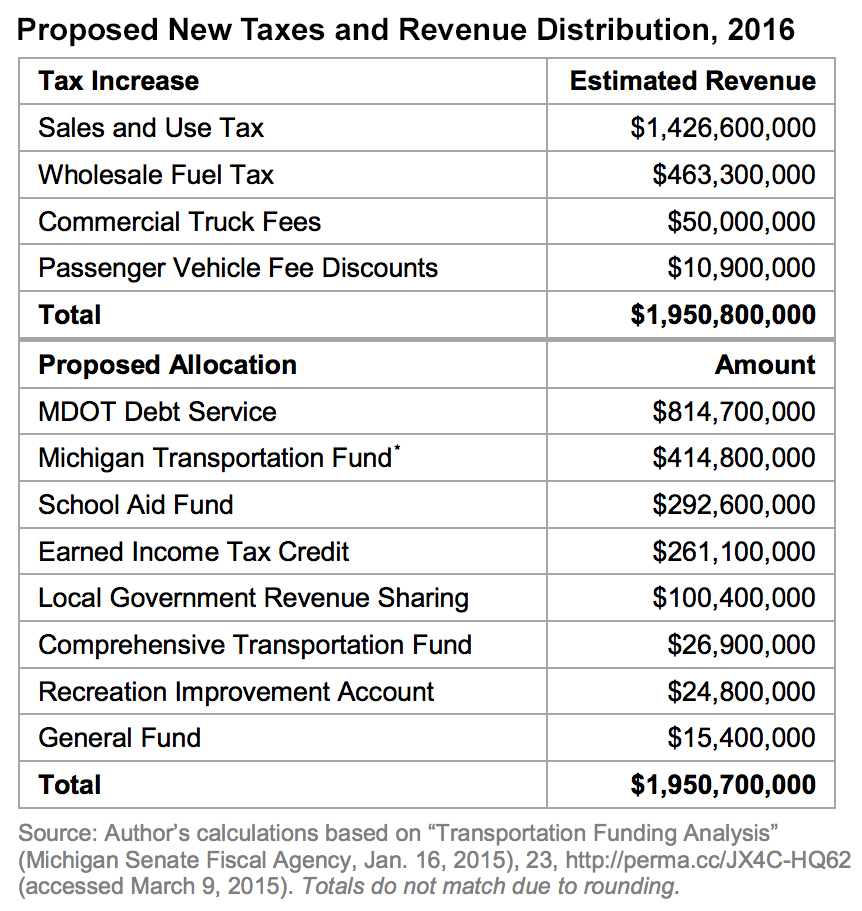

Michigan S May Tax Proposal Mackinac Center

Michigan Gas Tax Calculator Michigan Petroleum Association

Michigan Tax Rates Rankings Michigan Income Taxes Tax Foundation

Pin By Elaine Smith On Ny State In 2022 Gas Tax Highway Signs